ITALY-ASEAN / We begin a cycle of interviews and insights on Italian companies and realities present in Southeast Asia. This interview puts the spotlight on the CEO of Bonucchi e Associati Srl, a consulting company based in Milan and Singapore.

Rita Bonucchi is CEO of Bonucchi e Associati Srl, a management consulting company based in Milan and Singapore (since 2011), which deals with international marketing, export and internationalization strategies, with a long and solid presence in Southeast Asia. She is an Export Strategist, experienced trainer, and Management Consultant. Since 2020 she has also founded BeaConsulting Pte Ltd in Singapore, focusing on local clients and projects.

How did your business in ASEAN start?

Nel 1993 ho avviato un’attività di consulenza per la pianificazione marketing. All’epoca, non essendo così sicura dei volumi di lavoro, ho accettato un progetto di supporto al procurement di guanti monouso. Questo settore era distante dal mio solito focus di lavoro. Partendo da quella che fu una scelta casuale, ho iniziato a frequentare l’ASEAN dal 1993 e, in seguito a quell’incarico, avendo accumulato contatti e conoscenza di territorio, ho continuato a seguire altri progetti, che tuttavia restavano marginali rispetto alla mia attività principale.

In 2010 I supported the drawing up of a business plan for a consulting activity based in Malaysia. The following year my company, Bonucchi e Associati, came of age. From 1993 to 2010 we accompanied many companies in their internationalization strategies. So, I realized that the time to go abroad had come for us too. Internationalizing a service company is not easy, there are far fewer models. We decided to apply the same modus operandi that we use for our clients: checkup, selection of destinations, plan. The selection of destinations brought out ASEAN, also thanks to all that experience which began by chance. After an initial focus on Malaysia, it was clear that Singapore was the most suitable place for us. we have been investing in Singapore since 2011. Initially, we looked for partners and collaborators. Then we began to stabilize and set up a headquarters in Singapore, also investing in business trips. We went on more than four trips a year, with long stays, especially in summer.

In addition to this, a series of international projects for the European Commission took me to Indonesia, specifically to Bali. There I followed projects for SMEs and local artisans on empowerment for exports to the European Union. Following clients, missions, institutional projects, we reached another turning point in our history in ASEAN. In 2018 we became consultants for a government agency, Design Singapore, which deals with the promotion and development of Singapore design, locally and abroad. We are consultants for the internationalization in Europe of various Singaporean designers and architectural firms. Now we play a bigger role in this project, leading us to have even more specific needs. Until February 2020, I was flying to Singapore every month. A wide-ranging job with a very positive impact on our visibility in Italy, as part of this task, requires a matching between Singaporean designers and Italian producers.

What are the focal points of your work in Southeast Asia?

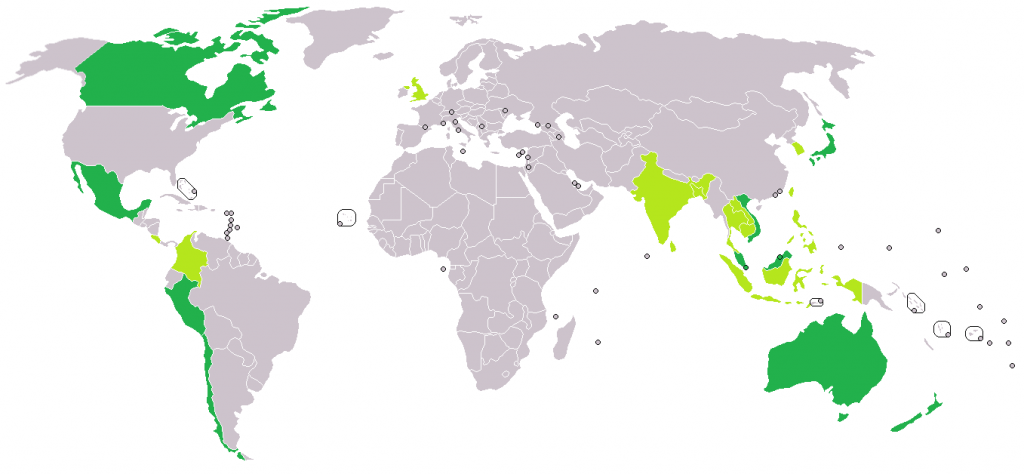

We do not have a closed sector specialization, but in the last ten years, we have focused our activity in ASEAN on a few sectors, including cosmetics and the whole beauty world. We handle the internationalization process in Southeast Asia of Cosmetica Italia, the association of cosmetics manufacturers within Confindustria. The other sector we focus on is Design: architects, engineers, manufacturers of systems, materials and products that have their destination within a building, up to furniture and furnishing textiles. We are now working a lot with the medical and agri-tech sectors. It is Singapore that guides us according to the new trends and fields it focuses on. We are equipped to follow the trends, also thanks to our local clients. Since 2020 we have found a 100% subsidiary company in Singapore, BeaConsulting pte ltd, focusing on local clients and projects. We operate both as an Italian company in Singapore and as a local company.

What are the reasons that led you to invest in Singapore?

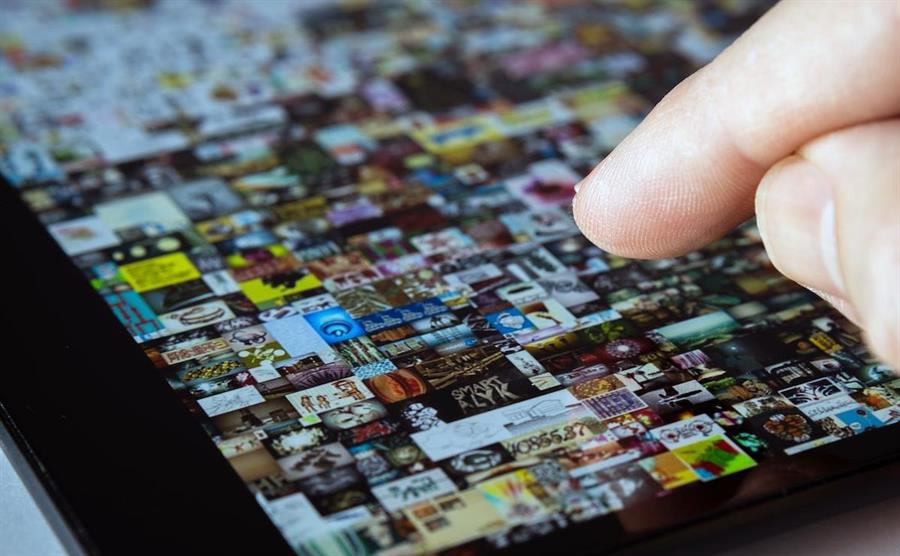

ASEAN fosters innovation, that's where things happen. This is the strongest motivation. We can not be there. It is a conviction for us and our clients, not a simple geographical attraction. Not being present in ASEAN means losing not only a slice of the business but above all the main wave of innovation, in terms of quality. It is a privileged observation point, particularly in Singapore, where many currents meet, especially those relating to the digital world. All the typical tools of the Western world and China are present. There is an enormous local liveliness, very visible from the e-commerce sector. Not being there means missing a piece of opportunity.

Other reasons concern the lifestyle and the way of doing business. In Singapore I become more productive, I work on networks much more intensively. Times are compressed: from the beginning of a business proposal to its closure, it takes less time, compared to Italy. The environment is more international. Even if I work in Milan, I feel that Singapore's speed is higher. There is a more developed international community, a concentration of capital that is of particular interest to startups and which tends to increase along with the growth of venture capital. The speed in the establishment of companies is predominant. Over the past year, we have set up various companies for our clients and opened checking accounts without physically being in Singapore, with relatively simple processes.

We employ a model whereby SMEs land first in Singapore and then cover the rest of the ASEAN countries. A traditional model, which response to a single consideration: many of the SMEs we dialogue with are neither ready to choose a single country nor to bear the costs and commitment of a settlement in terms of industrial and intellectual property, legal certainty, starting a business. In our opinion, Singapore remains unbeatable. The time to open in Vietnam, Thailand, Indonesia, and Malaysia can always come. Often, we find partners in Singapore who help us cover the other markets in the region.

Today, how is the response from Italian clients?

Our ten years of experience in the field gives us the strength that clients need. We still cannot get to their settlement that quickly. In addition to finding a partner in Singapore, we encourage companies to set up there as soon as possible and take advantage of the regional advantages, not least the grants available for companies with foreign capital. However, this vision is not yet fully embraced by the companies with which we dialogue. It takes more effort to get them to decide on a direct settlement. The most frequent request remains the development of an export project and the search for distributors. For this kind of service, we are accredited with the main funding programs (Maeci/Invitalia, Simest and others). For some products, we also push for direct access to local e-commerce.

History of your entrepreneurial activity: present and future developments.

Our present leans on our collaborators in Singapore who have allowed us to move forward during this period. First of all, our Project Manager Marianna Fichera.

Bonucchi e Associati is both in Milan and Singapore. The method and the work team are the same, although we are based in two different locations. This is very unusual for companies of our size. We also have local partners who, from the very beginning, have helped us to take root. They are still our point of reference in both Singapore and Malaysia. We can work at different levels because we can count on different types of collaborators. Through our group of collaborators on-site we increase our focus on ASEAN.

Thanks to our role as the brand ambassador of MM Design in Singapore, an award-winning industrial design studio, and membership in various local associations, we have achieved important recognitions as consultants and experts. Local companies can obtain funding from various Singapore government agencies even when working with us. We are working to be equated with a local consulting company also for the benefits reserved for the clients themselves.

We recently changed our headquarters in Milan, replicating what we have in Singapore inside the National Design Center. Paperwork is the co-working space that houses our office for the local team in Singapore, allowing us to benefit from the innovative and vibrant reality of the hub for the Asian market. To reproduce the model already tested in Singapore, we moved our headquarters to YoRoom space, a community of companies, freelancers, and start-ups, where talents and ideas meet in the heart of the Isola/Garibaldi district in Milan.

For the future, we expect a balance of employees in Singapore and Milan, maintaining the concept of a single team, hoping to return to travel soon. Having also strengthened the network that allows us to work in other ASEAN countries, we will formalize and strengthen these relationships. Singapore, Indonesia, and Malaysia are very well manned, followed by Thailand and Vietnam.

Which impact did the Covid-19 pandemic have on business processes?

The pandemic came while we were on the launchpad for many projects. At first, it was complicated, especially for the event’s cancellation, but then we figured out how to adapt to the situation, changing the way we work. Now we have settled down again.

The inability to travel from country to country is the biggest damage, so we are increasing the emphasis on Singapore. In all the projects, we initially focus on Singapore, expecting to be more incisive on the other countries as well. Before the pandemic, the work involved continuous movement. Now we have to wait and use our local references more. That very strong mobility is still unimaginable, which is one of the main characteristics of the ASEAN market. The lack of mobility was the most significant impact, which led us to concentrate on sectors that have their focus in Singapore: health-tech, agri-tech and food-tech, food security and supply chain, circular economy.

Regarding the sector of sustainability, we are involved in Coffeefrom, a circular economy project that creates, for example, cups with coffee grounds. The pilot project is in Italy, and we have the task of replicating it starting from Singapore. With the Green Plan 2030, Singapore is certainly the most visionary country in this direction. In addition, agglomeration economies are created, there is a great opportunity both to meet companies in the sustainability sector and their stakeholders. There are venture capital funds exclusively dedicated to startups committed to sustainability, such as Pufferfish Partners. In the need to work remotely and not being able to physically participate in events, it has become more important to deepen and maintain the virtual network with these subjects.

The role of women in Singapore entrepreneurship.

In Milan, we are a group of women and in Singapore, we have maintained this prevalence. I am very dedicated to the enhancement of Italian female professionals present in Singapore. I am a member of the Italian Women’s Group Singapore (part of the Singapore Business and Professional Women’s Association), which unites more than 120 Italian women in Singapore: managers, entrepreneurs, and many women who have moved for family reasons. In the latter case, very often their professional skills are compressed. Many professions are not replicable in Singapore, for example, those related to the legal world. In other cases, the continued mobility of the spouse makes it impossible to replicate a certain type of activity. Some women who work or have worked with me come from this range. Until now it was possible to make them work with the letter of consent for a visa, which can no longer be requested from May of this year, making the situation even more critical.

In Singapore, there is a highly developed female entrepreneurship, where comes out the role of Christina Teo of she1K, a competition open to female startups. The initiatives financed by CRIB are also very interesting. Singapore is a multi-ethnic country, sensitive to equal opportunities. Unfortunately, many professionals exported from Italy suffer a compression. To the present day, it is a wasted asset. Some women move from Italy with a position of value and do not find the possibility of continuing to express it in this framework. Some women opt for creating their businesses. There are interesting activities related to jewellery production, such as Italian Hands by Ilenia Circolani, and psychomotor skills, such as Sparkd | The Brain & Fitness Hub, founded by Anna Milani. However, in other sectors, it is not possible to have the same opportunities as in Italy.