New Delhi and Beijing are not only competing for the markets of their solar modules: their low costs of solar energy production, if combined with interconnection capabilities, can transform the Tiger and the Dragon into all-round "electrostates".

By Marco Dell'Aguzzo

Mukesh Ambani is the tenth richest man in the world and first in the list of billionaires in Asia. His wealth is linked to the fortunes of Reliance Industries, the Indian conglomerate famous above all for its petrochemicals: gas and crude oil, therefore. But Reliance, like almost all the big names in the hydrocarbon sector, has also embraced the energy transition and announced that it wants to reach net zero carbon emissions by 2035. The phrases speak for themselves, and there is no need to add much more: it is clear that behind the climate projects of big industries and big paper money there is not only the desire to participate in "saving the Earth", but above all that of reaffirming their economic presence in a changing world. And that, in the course of this change, will burn fewer and fewer fossil fuels and use more and more renewable sources. We are the ones who give energy a political dress. But in the mind of an entrepreneur thinking about selling, net of profitability, a barrel of oil is not too different from a solar panel.

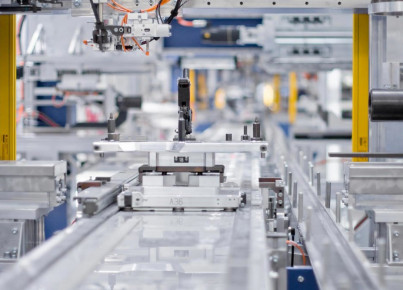

On October 10, Reliance made it known that it had purchased a Norwegian solar panel company from Chinese chemical company Bluestar for $771 million. A couple of days later, with 28 million it acquired the technologies of a German company that produces wafers (semiconductors) for photovoltaic cells. Within three years - these are the plans - Reliance will have invested 10.1 billion in clean energy, and by 2030 will have a solar capacity of at least 100 gigawatts, equal to the entire installed renewable India today.

The New Delhi government wants renewables to reach 450 GW by the end of the decade. Solar potential, in particular, is high, but currently only 4 percent of the electricity used in the country is generated from this source. Coal's share, by contrast, is huge, at more than 70 percent. It won't be this way forever, though. This is not said by a young activist from Fridays for Future but by the president of the state-owned mining company Coal India, the one that extracts the most coal in the world. It's a sector that will shrink in twenty to thirty years, says Pramod Agrawal, to make room for solar energy: Coal India plans to enter the photovoltaic wafer business, leveraging the fact that Indian factories produce cells and modules, but not these essential semiconductors.

The competition has just begun. Because Coal India's aim is also that of Reliance, which aims to make the country a large manufacturing hub of cheap but efficient solar panels, capable of conquering the market share of China (now the largest, clearly): it starts with an "integrated photovoltaic gigafactory" of 4 GW per year, which will become 10. Ambani's appetite is also shared by Gautam Adani, the billionaire chairman of the Adani Group, a company that deals in coal trading but will move on to add millions of renewable watts year after year. The government is participating in this industrial effort by raising barriers to the entry of solar modules and cells from abroad, with duties of 40 and 25 percent respectively starting next April.

Most PV equipment comes to India from China. Which, while strong in its advantage, is not just watching the moves of its regional rival, but is also trying to ride the global sustainability revolution. Last month, President Xi Jinping announced that the country had begun construction of a renewable mega-project in an undefined desert, the first phase of which (100 GW) exceeds India's entire wind and solar capacity. But to achieve carbon neutrality by 2060, as it says it wants, the world's largest greenhouse gas emitter will have to succeed in easing its dependence on coal. Similar to the Indian case, solar can be an effective substitute. Also because - according to a study by Tsinghua, Nankai, Renmin and Harvard Universities - by 2023 the prices of the two sources will be similar all over the country: in the northern and eastern areas the break-even will be reached already in 2021; while in the center, in the south and in the north-west in 2023. When combined with storage, solar could meet more than 40 percent of the country's electricity needs by 2060, without compromising grid stability and at a cost of as little as 2.5 cents per kilowatt hour.

Solar power tariffs in India are already very cheap: in the west-central state of Gujarat, for example, they have dropped below two rupees per kilowatt hour (about 2.6 cents on the dollar) and could halve by 2030. By that date, consulting firm Wood Mackenzie estimates that coal's wedge in the mix will be 50 percent and that building new power plants powered by the fuel will be 25 percent more expensive than solar plants. The International Energy Agency says that in 2040 - just nineteen years from now - the shares of coal and solar will be equal, and the nation will be able to rely on 140-200 GW of new battery capacity.

Tight timeframes but huge numbers, like ambition. India and China aren't just competing for markets to sell their solar modules: their low solar production costs, when combined with interconnection capabilities, can turn the Tiger and Dragon into well-rounded "electrostates" capable of generating and exporting large amounts of clean, cheap electricity to Asia. New Delhi is already building grid infrastructure with Bangladesh and Nepal; in 2016, Beijing established GEIDCO to reach as far as Africa and South America. It is not certain that these desires will come true; we are still in the space of the possible: to assert themselves abroad, the two neighboring powers will first have to succeed in meeting domestic needs. But energy, whether renewable or fossil, remains a question of geopolitical power.