Decarbonization and energy transition are key issues in Southeast Asia. The major players on the ground are Japan and China, whose rivalry in green finance can positively affect the region

On 7th May, the Asian Development Bank (ADB) announced that it would cease funding coal-fired power plants, fossil fuel extractions and activities for the production and exploration of oil and natural gas. The news is part of the ADB's Strategy 2030 published in 2018, in which the bank committed to cumulatively invest USD80 billion in sustainable financing between 2019 and 2030.

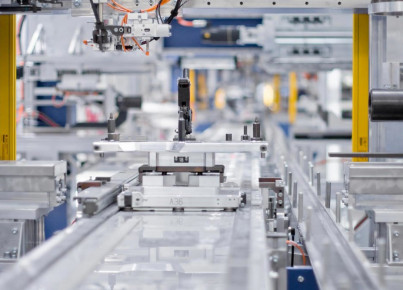

Since the second half of the 18th century, mankind has used fossil fuels to produce energy. Technological development gave impetus to the second industrial revolution in Europe, enabling the creation of the steam engine, which cut down the costs of transport and began to weave the first webs of what would soon become the globalised economy. Human progress continues to be measured in revolutions: now, it is the turn of a global renewable energy industry revolution and production processes that drastically limit our impact on the planet.

For developing countries such as the economies of Southeast Asia, this is a major challenge. On the one hand, these areas are particularly exposed to environmental disasters caused by anthropogenic climate changes; on the other hand, the economies of Southeast Asia are still in an undeveloped but emerging stage. For this reason, the tension between national choices and international sustainability imperatives plays a crucial role. In fact, coal remains the favourite source in the regional energy mix, for governments and businesses. The demand for electricity is growing fast in emerging markets, which is why it is a priority for governments to ensure supply at affordable prices. There is a misalignment between the political need to stimulate domestic demand while maintaining the production process competitive, and the need of foreign investors who stop financing activities that use obsolete technologies. In this regard, Tim Buckley of the Institute for Energy Economics and Financial Analysis said that if these banks stop financing it, coal is dead: "Coal is not bankable without government subsidised finance."

Indeed, the latest annual report from the International Energy Agency (IEA), published earlier this year, highlights how the massive population growth in Southeast Asia will play a crucial role in shaping global energy policies. In this regard, the Asian Development Bank had already scheduled with ASEAN a plan for sustainable infrastructure projects in April 2019: the ASEAN Catalytic Green Finance Facility, a green finance mechanism in the hands of regional governments, focused on developing climate-friendly projects, under the ADB supervision.

However, ADB is not the only one to have focused on Southeast Asia for its sustainable investments. The Japanese-based bank is called upon to compete with the Chinese-led Asian Infrastructure Investment Bank (AIIB), a multilateral financial institution focused on promoting infrastructure projects in Asia "with sustainability at its core".

China's role in Southeast Asia's decarbonization programs is ambivalent. As reported by Channel News Asia, the IEA claims that more than 80% of the growth in coal use will come from Asia and that this increase will be driven by China. In order to accelerate the post-pandemic recovery, Beijing increased the use of coal, aiming at stimulating its economy by fueling domestic demand. In addition, China remains faithful to the Marxist assumption that it is good to use the material tools available to the status quo before carrying out a revolution, in this case, an energetic one. The leadership's medium-term plans include an ambitious ecological transition, which aims to make the country carbon-neutral by 2060. Tim Buckley commented, in this regard, that China is a leader in every industrial sector that is critical for the decarbonization of the world, and this should allay Western fears about the reliability of the Party-State's commitments.

The substantial antagonism between China and Japan would seem to point towards virtuous competition in Southeast Asia, with the emphasis on sustainable infrastructure investments aligning with the urgency of environmental concerns in the region. For structural reasons such as geographical, economic and political-institutional issues, Southeast Asia remains a context particularly exposed to the consequences of the climate crisis, exacerbated by the irresponsible use of obsolete energy resources. Therefore, for national governments, the tension between unsustainable growth imperatives and the disruption of environmental disasters remains a historical challenge. This is why green finance can take on the role of game-changer in the region, shifting the balance in favour of more sustainable policies and practices in the near future.