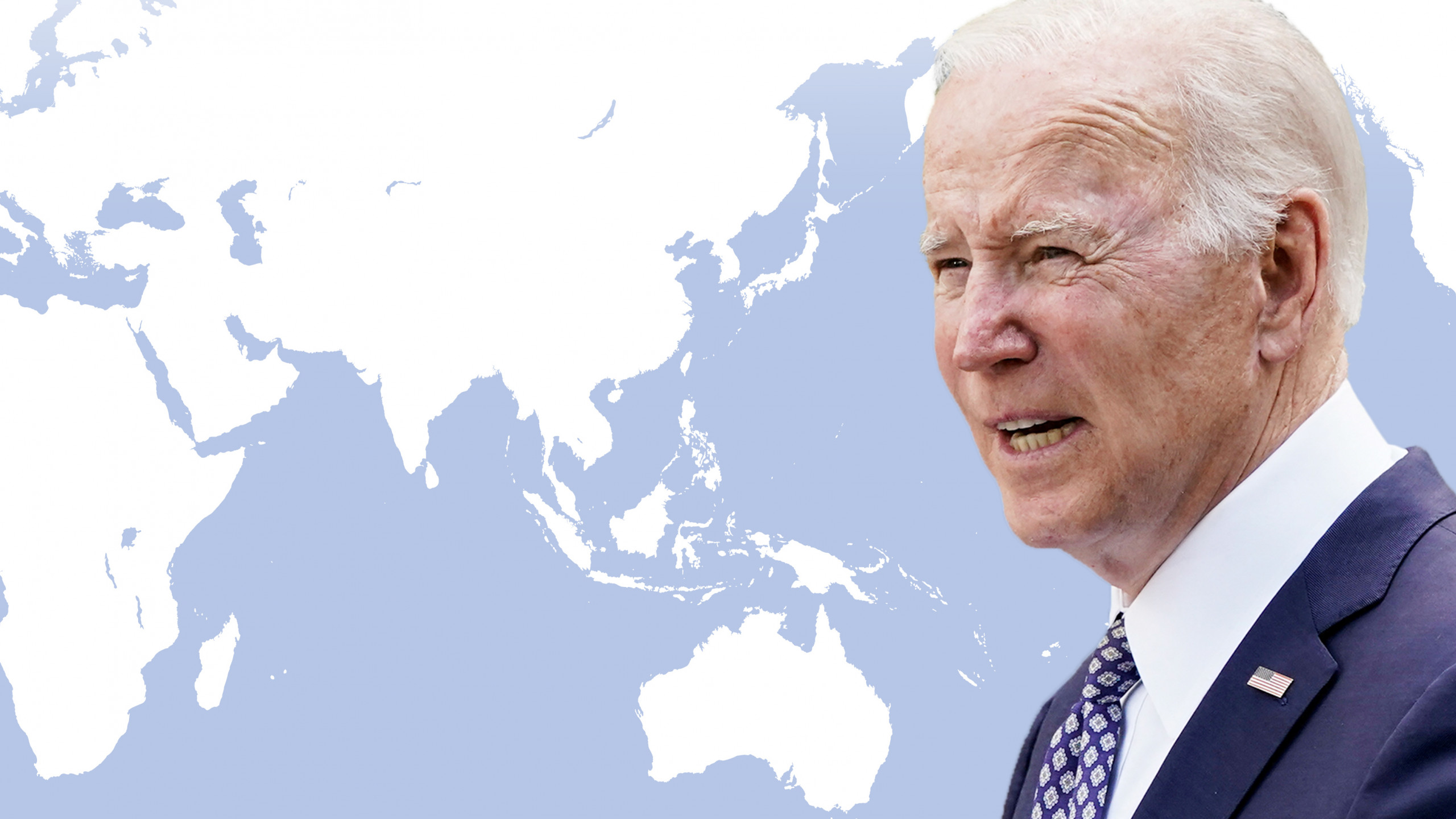

Grab, Gojek, Sea and Tokopedia: international finance bets on start-ups made in ASEAN

Wall Street recognized the potential of Southeast Asian start-ups. It is a much larger and much more populous region than Europe or North America and its economy, despite the pandemic crisis, is growing at a rapid pace. Nevertheless, to be successful in this market you need to master its main characteristics. It is no coincidence that Uber's businesses were entirely bought out by its local variant, Grab, in 2018. As well as China's Alibaba has struggled long to outclass Lazada, a regional e-commerce company.

In recent years, the landscape of Southeast Asian tech start-ups has expanded more and more. Digital services such as ride-hailing or delivery have become increasingly popular. Since 2015, venture capitalists, technology groups (including Alibaba and Tencent, Google and SoftBank) and Wall Street veterans have invested $ 26 billion in the region. The capitalization of the Sea group, a Singaporean e-commerce company listed in New York, has quadrupled in the last year, reaching USD 125 billion. Grab also recently went public for nearly USD 40 billion, backed by BlackRock, the world's largest asset manager. Gojek, the Indonesian ride-hailing alternative has been valued at over USD 10 billion and could merge with Tokopedia, an Indonesian e-commerce company, before accepting being listed in New York. Traveloka, a company specialized in airline reservations, is also about to go public on Wall Street. The most valued and used e-commerce services in the region together exceed the value of USD 200 billion.

All of these companies started by carving out a niche market. Then, they evolved to become direct competitors of the American and Chinese companies of the same kind. Grab is present in eight countries, and in addition to transport it offers food delivery services, digital payments, insurance, investments and health consultancy. It also plans to launch a digital bank in Singapore this year. One of its co-founders, Tan Hooi Ling, describes it as a mix of Uber, DoorDash (a US-made food delivery app) and Ant (Alibaba's financial branch). In short, a super app that includes services normally distributed on multiple platforms. Same goes for Gojek, which offers a similar catalog of services.

However, the exponential growth of these platforms is not predetermined. If the quality of the infrastructures and communication networks does not improve, many of the potential users will be cut off. Especially if companies find it unprofitable to offer their services in certain areas. The problem was raised in reference to the particular geographic conformation of Indonesia which hosts more than 6,000 islands and does not have the infrastructural network of neighboring China. Not to mention that a large part of the population has a very low income, with little money available to shop online. And even if the emerging platforms managed to overcome these obstacles, sooner or later, they would inevitably find themselves overlapping one another. Grab and Gojek already compete for the same market.

Risks that are amply justified by the excellent results. After all, high growth translates into tolerant investors; Sea's revenues increased by 101% last year and Grab expects to reach a balanced budget by 2023. Indeed, many investors argue that the Southeast Asian market is so vast and varied that it is impossible to form monopolies. This confirms the words of Gojek founder Kevin Alawi, "it is not a market in which whoever wins takes everything". A prospect that presents many opportunities for Western investors, especially in a post-pandemic context and the recovery of domestic consumption.